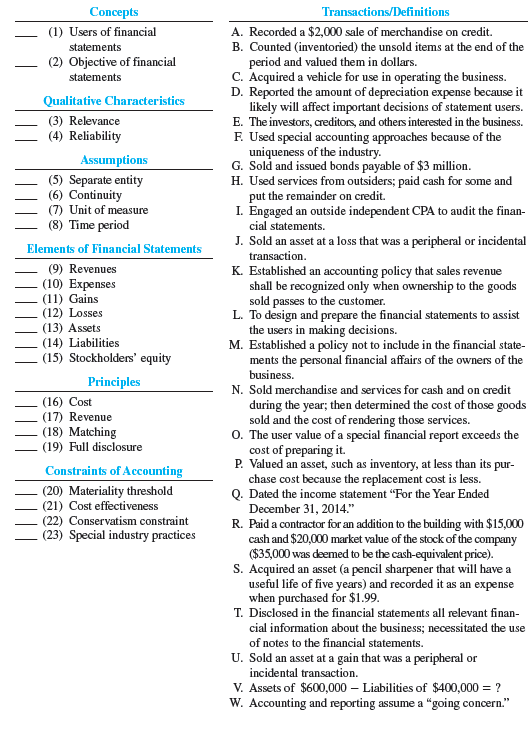

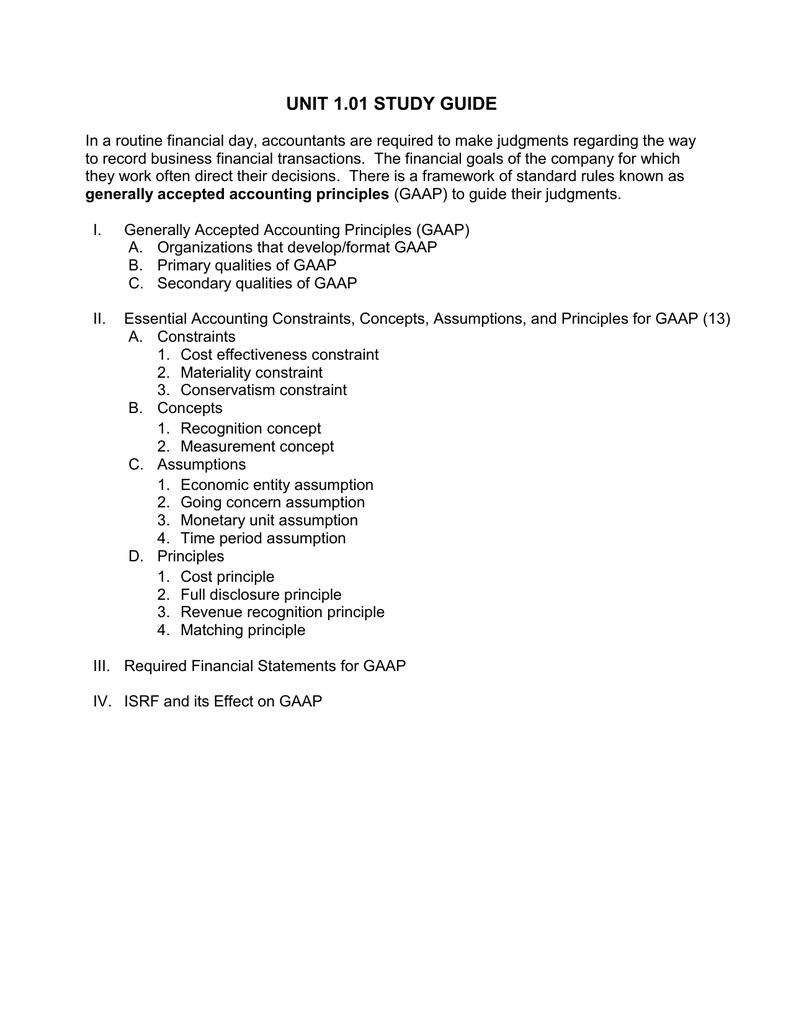

If a transaction is material enough to exceed the constraint threshold then it is recorded in the financial records and therefore appears in the financial statements if a transaction does not meet this threshold level it may not be recorded in the.

Concept of materiality as a constraint in accounting.

They are described below.

The materiality concept in accounting is also known as materiality constraint.

While cost benefit and materiality are the two overriding accounting constraints industry practices are a less dominant constraint but also part of the reporting environment.

The concept of materiality in accounting is very subjective relative to size and importance.

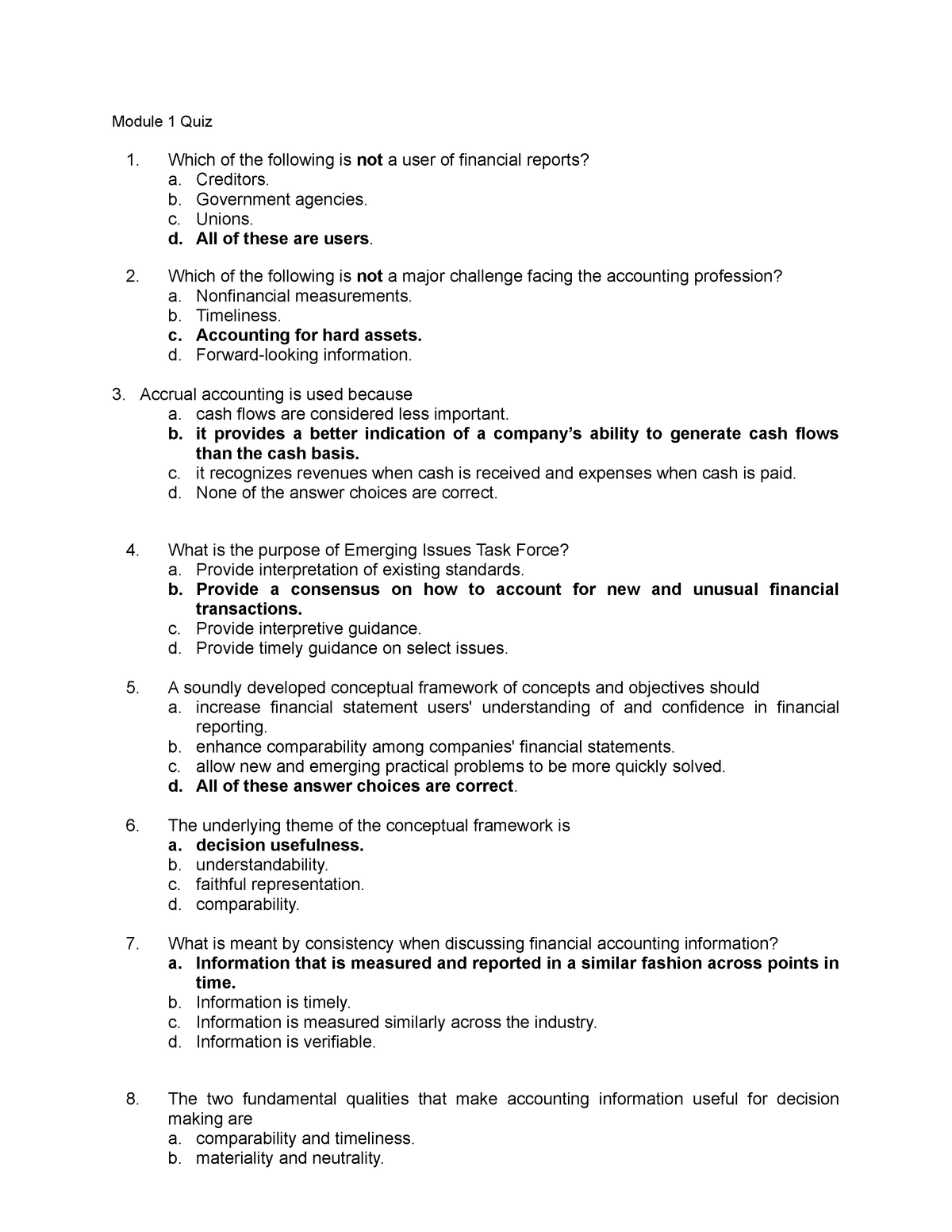

6 constraints of accounting are.

According to this principle the cost of applying an accounting principle should not be more than its benefits.

Fundamental accounting concepts and constraints.

Financial information might be of material importance to one company but stand immaterial to another company.

Here is a list of the four basic accounting concepts and constraints that make up the gaap framework in the us.

The items that have very little or no impact on a user s decision are termed as immaterial or insignificant items.

Cost benefit principle materiality principle consistency principle conservatism principle timeliness principle and.

The materiality concept is the universally accepted accounting principle reporting firms must disclose all such matters.

This video give the basic concept of materiality concept materiality constraint in accounting urdu hindi my recommenmd amazing gears products.

Particular industry practices in financial reporting may cause departure from basic accounting standards for companies in certain industries.

The materiality concept helps ensure that firms do not withhold critical information from investors owners lenders and regulators.

If the cost.

This aspect of the materiality concept is more noticeable when.